Complete guide: Golden Visa Portugal program in 2024

The Golden Visa Portugal program has emerged as an opportunity for non-European investors seeking dual citizenship, but also robust returns on their investments abroad.

Since its inception in 2012, the Golden Visa has attracted a steady flow of foreign capital, including US citizens, boosting vital sectors of the Portuguese economy, such as technology, tourism, and culture.

In this article, we’ll explore the nuances of the Golden Visa Portugal Program, from the eligibility requirements to the benefits of acquiring the golden visa. You’ll also learn about the recent changes in legislation, the different types of investment available, the application process, the fees involved, and the path to Portuguese citizenship.

Check out the content and find out how this updated guide can help you.

Enjoy reading.

What is the Golden Visa Portugal program?

The Golden Visa Portugal Program is a Portuguese government initiative that allows citizens from outside the European Union to obtain a residence permit in Portugal by investing in the country.

The Golden Visa was launched in 2012 specifically to help combat the global financial crisis of 2008.

Thus, by granting temporary residence to non-European investors who commit to making significant investments in the country, the program promotes the entry of foreign capital into key sectors of the economy, such as accommodation, technology, research and development, among others.

By offering the prospect of residency in the European Union and, eventually, Portuguese citizenship, the program has positioned Portugal as an attractive destination for investors seeking financial returns, quality of life, security and access to one of the most integrated markets in the world.

What is ARI – Residence Permit for Investment Activity in Portugal?

An acronym that always goes hand in hand with the Golden Visa Portugal is the ARI (Residence Permit for Investment Activity), which is nothing more than the legal term for the status granted to foreign investors under the program, i.e. the official name of the Golden Visa.

The ARI is initially granted for a period of two years and can be renewed for additional periods of three years, as long as the conditions of the investment are maintained.

Figures for the Golden Visa program in Portugal

By August 2023, Golden Visa Portugal had granted 12,718 Residence Permits (ARIs) to investors from various countries, with China leading the number of ARIs granted (5,407), followed by Brazil (1,256), USA (781), Turkey (613) and South Africa (574).

This flow of foreign investment has had a significant impact on the Portuguese economy, attracting more than 865 million euros in investments through the transfer of capital, representing around 12% of the total invested in the program since its implementation.

Golden Visa Portugal has also benefited 20,424 family members of investors, expanding its impact beyond the investors themselves and contributing to the diversification and internationalization of Portuguese society.

Why is the Golden Visa Portugal so popular?

Well, looking at the number of permits the program has already granted, you can assume that there are good reasons, in addition to those already mentioned, why it is so sought after by foreigners, especially Chinese and Americans.

In fact, the Golden Visa Portugal reflects a balance between the economic and qualitative benefits that the country offers.

Here are some of the main factors that contribute to the program’s popularity:

Access to the European Union

Obtaining the Golden Visa Portugal gives investors and their families the right to live, work and study in Portugal, as well as free access to the Schengen area, facilitating mobility within 26 European countries without the need for additional visas.

Residence process for citizenship

After five years of legal residence, investors can apply for Portuguese citizenship, offering an attractive route to a European passport, which is highly valued for its global travel power and the rights it confers within the European Union.

Quality of life

Portugal is known for its high quality of life, including safety, mild climate, rich culture and history, beautiful landscapes and an extensive coastline to visit. These factors, combined with a relatively low cost of living compared to other European countries, make Portugal a desirable destination for living and investing.

Favorable tax regime

The NHR (Non-Habitual Resident) program, which offers reduced tax rates or tax exemption on certain types of income, is another attraction for foreigners, including Golden Visa Portugal beneficiaries.

Favorable business environment

Another good reason is that Portugal has an entrepreneurial and investment environment eager for new business, with various government initiatives aimed at fostering innovation, startups and foreign investment, all complemented by a skilled workforce and competitive operating costs.

Diverse investment options

To make it even more attractive to different needs, the program has been adjusted to encourage investment in various areas, including investment in research and development, support for arts and culture, as well as the tourism and accommodation sector, offering investors a wide range of options to qualify.

What are the types of investments for Golden Visa Portugal?

Investors can choose between several types of investment, each with a minimum amount required.

So, considering these changes, here are the updated options and the corresponding amounts:

Support for art or reconstruction

Requires an investment of €250,000 or more in preserving cultural heritage or supporting the arts.

Investment in research

Requires an investment of €500,000 or more in research activities conducted by public or private research institutions that are part of the national scientific and technological system.

Investment in venture capital funds

Here the investment is also €500,000 or more in venture capital funds or investment funds that commit to investing in companies based in Portugal.

Job creation

For this modality you must guarantee the creation of at least 10 jobs (the number can be reduced to 8 jobs if the investment is made in areas of low population density).

Investing in a commercial company based in Portugal

Valid for investments of 500,000 euros or more, aimed at setting up a commercial company with its registered office in Portugal. In addition, five permanent jobs must be created.

Important to know: with the recent update to the program’s legislation, some investment options have changed, including restrictions on real estate investments for housing.

How to invest in Golden Visa Portugal?

- Creation of at least 10 new positions;

- 500,000€ for scientific research activities;

- 250,000€ for artistic production or maintenance of national heritage

- 500,000€ in securities investment funds

- 500,000€ for the creation of a local company, or investment in an existing company with the creation or maintenance of 5 employment positions.

Details of each type of investment

Support for Art or Reconstruction

In this investment model, the applicant has the opportunity to contribute to culture, art and the preservation of Portugal’s historical heritage. It is dedicated to those who are interested in combining their investment objectives with a positive cultural and social impact.

Investment amount: €250,000

The investor must make a minimum investment of 250,000 euros in activities to preserve cultural heritage or support the arts, in projects approved by the Portuguese government. The corresponding amount in dollars is around $270K.

How it works?

Projects selection

The investment should be directed towards specific projects that qualify under the scope of supporting art or reconstructing cultural heritage. These projects are often managed or recognized by government entities responsible for culture and heritage.

Direct contribution

The amount invested is used directly, including – but not limited to – restoring historic buildings, supporting cultural institutions, financing art exhibitions or sponsoring cultural activities that promote Portugal’s cultural heritage.

Application process: supporting documentation

As with other Golden Visa Portugal investment categories, it is necessary to submit documentation proving the investment made, including contracts, receipts and, in some cases, certificates issued by the benefiting cultural or artistic entities.

Research Investment

The Research Investment option with the Golden Visa Portugal is aimed at those who wish to contribute to the country’s scientific and technological progress. This option allows investors to directly support research and development (R&D) in strategic areas for Portugal, promoting innovation and competitiveness on the global stage.

Investment amount: €500,000

The investor must make a minimum investment of 500,000 euros in research activities carried out by public or private institutions integrated into the national scientific and technological system.

How it works?

Selection of R&D projects

The investment must be earmarked for specific research and development projects, which can cover a wide range of areas, including technology, health, energy and the environment, as long as they contribute to science and innovation in Portugal.

Contribution to qualified institutions

The amount invested is allocated to research institutions recognized by the Portuguese government, which are actively involved in R&D projects. These institutions can be universities, research laboratories, technology startups or other entities that are part of the country’s innovation ecosystem.

Application process: supporting documentation

As with the previous category, the investor needs to provide documentation proving the investment made, including investment contracts, payment receipts and, in some cases, certificates or statements issued by the R&D institutions benefiting.

Venture Capital Funds

This type of investment is focused on injecting capital into funds which, in turn, invest in companies with high growth potential in various sectors of the Portuguese economy, such as tourism and technology.

A specific option within this category is investment in the VIDA Fund, which stands out for its strategic approach and focus on sustainable accommodation.

Investment amount: €500,000

The minimum investment amount required to qualify for the Golden Visa Portugal through venture capital funds is 500,000 euros or around $535K.

VIDA Fund in detail

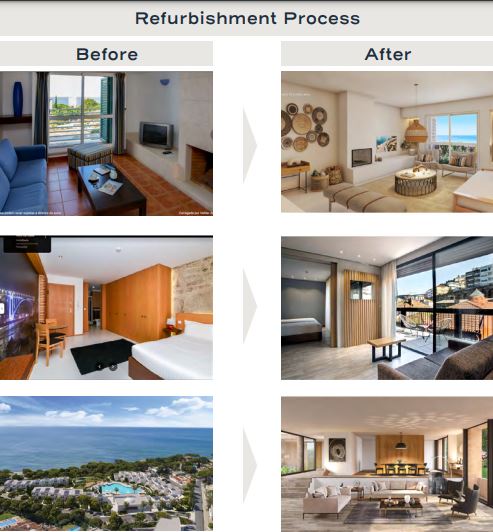

The VIDA Fund is an innovative initiative that seeks to capitalize on the hospitality sector in Portugal, with a particular focus on sustainability and positive social impact.

Fund purpose

Investing in and operating projects in the sustainable hospitality market, transforming undervalued properties into profitable ventures is the objective of the VIDA Fund. In doing so, the fund not only promotes economic growth, but also generates consistent returns for investors.

VIDA Fund asset improvement process

Investment strategy

The VIDA Fund uses an integrated owner-operator approach, which guarantees comprehensive, hands-on management throughout the entire process of developing and operating the accommodation. This includes everything from the acquisition of assets to the implementation of operational and environmental improvements.

Application process: fund selection and documentation

The investor must select a qualified venture capital fund, such as the VIDA Fund, and make the investment in accordance with the terms and conditions established by the Golden Visa Portugal Program.

Documentation must be provided to prove the investment made in the chosen fund, including proof of transfer and subscription contracts.

Job opportunities

Investment Value and Job Creation Requirements

In this modality, the investor needs to create a minimum of 10 new jobs in Portugal as part of their investment. This number can be reduced to 8 jobs if the investment is made in sparsely populated territories.

How it works

Setting up a business

Generally, the investment involves setting up or acquiring a company in Portugal. The investor must register the company and fulfill all the legal and tax obligations associated with doing business in the country.

Hiring workers

After setting up the company, the investor must hire at least 10 local workers, registering them with the Portuguese Social Security. It is important that the jobs are maintained for a minimum period, which generally coincides with the qualifying period for the Golden Visa Portugal.

Proof of investment

As with the other options, in order to apply for the program it is necessary to provide documentation, in this case, that proves the creation of jobs, including employment contracts, Social Security records and other documents that show compliance with this requirement.

Compliance with labor regulations

Ensuring that all hiring and employment practices are in full compliance with Portuguese labor laws, including wages, working conditions and social security contributions, is another requirement you must meet.

Investing in a new or local company

Minimum investment amount and conditions

To qualify for the Golden Visa by investing in a commercial company based in Portugal, a minimum investment of 500,000 euros is required.

This amount is intended for setting up a new company or investing in an existing one, with the additional condition of creating at least five permanent jobs.

How it works

The process begins with choosing the company or project in which the investment will be made. This can be a new venture or a stake in an existing company. The investor can choose from a variety of sectors, as long as the business activity is carried out on national territory.

Job creation

One of the requirements of this modality is job creation. Thus, after the investment, the company must create and maintain five jobs for a period of 5 years.

Associated benefits

In addition to the possibility of residing in Portugal and potentially obtaining citizenship after five years, this type of investment offers the investor the chance to actively participate in the Portuguese economy, benefiting from the innovative business environment and Portugal’s strategic location as a gateway to the European and African markets.

Documents required

To apply for the Golden Visa, it is necessary to provide documentation proving the investment made, including:

- Company articles of association or investment contract.

- Proof of transfer of funds.

- Social security records and other documents showing the creation and maintenance of jobs.

What to take into account when choosing an investment fund for the Golden Visa?

When choosing a venture capital investment fund to obtain the Golden Visa, you need to take into account: alignment with the investment objectives, the fund’s track record and management team, structure and terms, growth potential, rate of return, compliance with the ARI Program, risks and sustainability, as well as social impact.

Exemplified by the VIDA Fund

- Alignment with investment objectives

Make sure that the fund you choose aligns with your long-term investment objectives, be it capital growth, income, sustainability or a mix of all options. The VIDA Fund, for example, focuses on projects in the sustainable lodging market, offering an opportunity for investors interested in sustainability and positive social impact.

- Track record and credibility of the management team

This is an important tip: investigate the background and experience of the fund’s management team. A team with a strong track record in areas relevant to the fund’s focus can increase confidence in the investment’s potential for success. In the case of the VIDA Fund, you should consider the team’s experience in hospitality, asset management and sustainability.

- Fund structure and terms

Understand the structure of the fund, including management fees, investment and exit terms, and any rights and obligations of investors. With the VIDA Fund, it is important to understand how investments will be allocated to sustainable hospitality projects and what the return expectations are.

- Growth potential and return

Evaluate the fund’s growth and return potential, including the past performance of similar investments, if available. The VIDA Fund offers a clear vision of its profitability targets and how it plans to achieve them through its sustainable hospitality investment strategy.

- Compliance with the Golden Visa Portugal

Also check that the fund complies with the requirements of Golden Visa Portugal, especially in terms of the minimum investment amount and the nature of the investment. The VIDA Fund, by qualifying as a venture capital fund for the Golden Visa, complies with these legal and regulatory requirements.

“We offer complete advice on obtaining the Golden Visa through the VIDA Fund, guaranteeing a simplified and secure process for our investors. With our experience, we turn complexity into a smooth and successful journey.” (Maria Alvarez, partner at Vida Advisors)

- Associated risks

It is also very important to understand the risks associated with investing in the fund, including any specific market or sector factors that could affect the return on investment. Evaluate how the VIDA Fund manages these risks, especially in the context of investments in hospitality and sustainability.

- Sustainability and social impact

For investors interested in social impact and sustainability, it is essential to consider how the fund incorporates these elements into its investment strategy. The VIDA Fund, for example, can offer insights into how its investments in sustainable hospitality contribute to broader environmental and social goals.

When choosing an investment fund like the VIDA Fund for the Golden Visa Portugal program, a careful assessment of these factors can help ensure that the investment not only complies with the program’s requirements, but is aligned with your personal financial goals and values.

Ideal investor profile for Golden Visa Portugal: Who can apply?

After seeing the variety of modalities available, you can conclude that the Golden Visa Portugal program is designed to attract a wide range of international investors, and does so by offering them the opportunity to obtain residency (and potentially citizenship) in exchange for making significant investments in the country.

As such, the ideal investor profile for Golden Visa Portugal can vary depending on one’s specific objectives and financial situation, but generally includes the following characteristics:

High-capital investors

Individuals or families with the financial capacity to make the minimum investment required by the program.

Entrepreneurs and business people

People looking to expand their business to Europe and who see Portugal as a strategic point due to its location, stable economy and business-friendly environment.

Retirees

Individuals who wish to enjoy their retirement in a country with a high quality of life, a mild climate and a rich culture, and who have the financial means to invest in Portugal.

Liberal professionals and executives

Professionals seeking international mobility for themselves and their families, access to quality education for their children and a safe and healthy lifestyle.

Real estate investors

Those interested in the Portuguese real estate market. Although recent legislation has restricted investment in residential property, there are still opportunities in sectors such as tourism and services.

Sustainability supporters

Investors who are committed to sustainability and social impact, and who are looking to invest in funds or projects that promote cultural preservation, research and development or environmental sustainability, such as the VIDA Fund.

Second citizenship or residency seekers

Individuals who wish to obtain a second citizenship or residence as part of their wealth diversification strategy or personal and family security planning, taking advantage of the benefits of living in or having easier access to the Schengen area.

Basic application requirements

The Golden Visa Portugal program is particularly attractive to those who value global mobility, security and the possibility of investing in a stable and growing economy.

Every investor profile can find in Portugal a unique opportunity to combine their investments with a desirable lifestyle and a potential path to European citizenship and, to get started, you need to meet the basic requirements, which are:

- Be a non-European Union (EU), European Economic Area (EEA) or Swiss national;

- Have a clean criminal record, both in your country of origin and in Portugal;

- Have the financial capacity to make the necessary investment;

- Commit to maintaining the investment for a minimum of five years;

- Have valid health insurance in Portugal.

How the Golden Visa Portugal Program works step by step

So far you’ve seen what the Golden Visa Portugal program is, what the modalities are, the profile of the investors and the basic requirements for joining. Now we’re going to organize how the program works in “steps” to clarify ideas, but remember to rely on the support of experts in your specific case when putting your plan into practice.

Step 1: Checking the requirements

Before starting the process, it is important to check that you meet all the requirements necessary to apply for the Golden Visa Portugal, including the amount of the investment, the origin of the funds, and the absence of a criminal record.

Step 2: Choosing the type of investment

Decide what type of investment you intend to make, which can range from buying real estate, investing in venture capital funds, creating jobs, to supporting art or reconstruction. Each type has a minimum investment amount associated with it, as explained above.

Step 3: Making the investment

Make your chosen investment in a qualified fund, such as the VIDA Fund, which focuses on sustainable hospitality projects.

Step 4: Collecting the necessary documentation

Gather all the necessary documentation, which may include passports, proof of the investment made, criminal record certificates, proof of valid health insurance in Portugal and other documents that may be required by AIMA.

Step 5: Submitting the application

Submit your application to AIMA, along with the necessary documentation and payment of the applicable fees. Submission can be done online, followed by an appointment for biometrics and a face-to-face interview.

Step 6: Approval and issue of the Golden Visa Portugal

Once your application has been analyzed by AIMA, if everything meets the requirements, you will receive approval for your Golden Visa Portugal, but be aware that this process can take several months.

Step 7: Renewing your visa

Even after you get your Golden Visa Portugal, it will need to be renewed after one and two years from the initial issue. Each renewal requires the submission of new documents proving that the investment has been maintained and that the minimum requirements for staying in Portugal have been met.

Step 8: Applying for permanent residence or citizenship

Once you have been legally resident in Portugal for five years, proving everything necessary during this period, you can apply for permanent residence or Portuguese citizenship, provided you meet the additional requirements, including proof of basic knowledge of the Portuguese language and ties to the Portuguese community.

Despite the 8 steps described above, this process is an overview and may vary depending on changes in legislation or AIMA procedures. It is therefore highly recommended that you consult a specialist immigration lawyer for guidance and support throughout the Golden Visa Portugal application process.

What is the minimum period of stay in Portugal on the Golden Visa?

When we talk about “minimum period of stay”, we mean the minimum time that Golden Visa Portugal holders need to remain in the country in order to maintain their eligibility for the program and, eventually, for visa renewal and for applying for permanent residence or Portuguese citizenship.

This requirement is an integral part of the Golden Visa Portugal program because it aims to ensure that investors create a genuine bond with the country, even though the program allows for great flexibility of movement and does not require the investor to reside permanently in Portugal.

First two years

Once the Golden Visa Portugal has been granted, the holder must spend a minimum of 7 days in the country during the first year, and a further 7 days during the second year, whether consecutive or not.

Next three years

For subsequent renewals of the visa, the holder is required to spend a minimum of 14 days in Portugal, consecutive or not, during each two-year period.

These minimum stay requirements are considerably lower than the requirements for other types of visas or residence permits, making the Golden Visa Portugal very attractive for investors who do not wish or cannot commit to living in Portugal full-time.

Importance of compliance

Compliance with these requirements is crucial for maintaining Golden Visa Portugal status and for investors who eventually wish to apply for permanent residence or Portuguese citizenship.

If you don’t comply with these requirements, you may encounter difficulties in renewing your visa, and it may even affect your eligibility for permanent residence or citizenship.

Documentation and control

Golden Visa Portugal holders must keep documentation proving their stay in Portugal, such as plane tickets and receipts for accommodation (hotel, rent) to present to the Portuguese authorities when requested, especially during the visa renewal process.

What are the changes to the Golden Visa Portugal law in 2023?

The draft law approved in 2023 stipulated the end of the Golden Visa Portugal for the modalities of capital transfer of 1.5 million euros and the acquisition of real estate with a value of 500,000 euros and 350,000 euros (the latter subject to rehabilitation works).

What happens to ongoing cases after these changes?

Applications already submitted before the implementation of the new law remain valid under the old rules. This ensures that investments and applications started under the previous regime will not be affected by the new rules.

Residence permits granted under the now-excluded investment modalities will be converted into “residence permits for entrepreneurial immigrants” on renewals, maintaining the minimum periods of stay in Portugal.

These changes have not come about for nothing. They reflect a significant restructuring of the Golden Visa Portugal program, with the aim of adapting investment avenues to the country’s current needs, while encouraging investments that have a broader positive social and economic impact.

Therefore, as an interested investor, it is essential to review these new options and consider expert advice to ensure compliance and maximize the benefits of your investment.

Will the Golden Visa end?

With the changes seen above already circulating on the internet, many people interested in the program are wondering if it will be abolished. But you can rest assured that the Golden Visa in Portugal is not going to end completely, even though it has undergone several changes in recent times.

Keep in mind that, while certain investment options have been removed, the program itself is still active, adjusting more and more to encourage forms of investment that promote a broader positive social and economic impact in Portugal.

Documents for the Golden Visa

To obtain a Golden Visa in Portugal, investors need to present a series of essential documents during the application process and, as you saw earlier, this documentation varies according to the type of investment chosen. Here are the main documents required:

Passport or other valid travel documentation: for the applicant’s personal identification.

Proof of investment made: documents proving that the investment qualified for the Golden Visa Portugal program has been made, which may include proof of job creation or proof of investment in venture capital funds.

Criminal record certificate: issued by the country of origin or any country where the applicant has resided for more than one year.

Proof of Health Insurance: valid in Portugal, which can be private health insurance or the European health insurance card in the case of EU citizens.

Declaration of Commitment of Honor: where the applicant declares that they will meet the minimum investment requirements for a minimum period of five years.

Residence Permit for Investment Activity (ARI) form: duly completed.

Dependent identification documents: if applicable, to include family members in the process, such as spouses, dependent children and dependent parents.

Proof of payment of service fees: receipts proving payment of the administrative fees associated with the Golden Visa Portugal application.

Declaration of Authorization to Consult the Portuguese Criminal Record by AIMA: allowing the Aliens and Borders Service (SEF, now AIMA) to check the applicant’s criminal record in Portugal.

These documents must be presented in Portuguese or translated into Portuguese by a certified translator and, depending on the case, additional documents may be required.

When going through this stage, it is essential to check the updated list of required documents on the official website of the immigration agency.

Golden Visa Portugal 2024: Investing and living in the Algarve

What are the costs and fees of the Golden Visa Portugal?

Although the aim of the Golden Visa Portugal is to bring high levels of investment into the country, applicants still have to pay some fees throughout the process and in addition to the investment they will be making. See what they are:

Initial fees

Analysis fee: when submitting the Golden Visa Portugal application, an analysis fee is charged. This fee is approximately €773.74 per main applicant and also for each family member included in the application.

Residence Permit application processing fee: once the initial analysis has been approved, there is a processing fee for the issuance of the Residence Permit for Investment Activity (ARI). This fee is around €7,730.11 per person (main applicant and dependents).

Renewal fees

The fee costs approximately €3,865.79 per person.

How long does it take to get the Golden Visa?

The time required for the Golden Visa Portugal process can vary according to several factors, including the complexity of the case, the speed with which the necessary documents are gathered and submitted, and the current workload of AIMA: Agency for Migration Integration and Asylum. However, it is possible to have a general estimate based on standard procedures:

Application submission and initial analysis

After the complete submission of the application and all the necessary documents, AIMA usually takes around 90 days to analyze and process the initial application. This period can vary, especially in times of high demand.

Scheduling the interview

Once the initial analysis has been successfully completed, the agency can schedule an interview with the applicant. The waiting time for the interview can vary considerably depending on the region of Portugal in which the application is submitted and the workload at that time. In some cases, scheduling the interview can take several months.

Final decision and issuing of the Golden Visa

Once the interview has taken place and any additional documents requested have been submitted, the final decision on the granting of the Golden Visa Portugal is usually issued within 60 days. Once the residence permit is approved, the applicant receives a valid residence permit.

Total estimated time

Considering all the stages, from the submission of the application to the issuing of the Golden Visa Portugal, the process can take, on average, between 6 and 9 months. However, it is important to note that this is only an estimated time and that the process can be faster or slower depending on the factors mentioned above.

Tips for speeding up the process

Although not all of the steps depend on the applicants, it is worth paying close attention to all the requirements, documentation, fees and deadlines to speed up the process as much as possible, at least as far as it depends on you.

Submit complete and correct documentation

Make sure that all documentation is complete, correct and duly translated into Portuguese by a certified translator (if they are not originally in Portuguese). This can help avoid delays.

Rely on professional advice

The support of professionals specializing in Golden Visa Portugal can help you navigate the process more efficiently and avoid common mistakes that cause delays.

How do I renew my Golden Visa Portugal?

Let’s recap some important information about renewal and its requirements. The first ARI (Residence Permit) granted through Golden Visa Portugal is valid for two years. After this period, the permit can be renewed for subsequent two-year periods, as long as the program requirements mentioned above are met.

Renewal process

To renew the Golden Visa Portugal, the holder must demonstrate that they have maintained the investment during the period of validity of their residence permit and meet the following requirements:

Documentation

Renewal requires the submission of a number of documents, which may include a valid passport; health insurance valid in Portugal; proof of maintaining the investment; a criminal record certificate from Portugal and the country of origin or another country where you have resided for more than one year; proof of the minimum periods of stay in Portugal and proof of payment of the renewal fee.

Renewal application

The renewal application must be submitted online via the AIMA portal, usually 30 days before the expiry date of the residence permit and no more than 90 days before.

Renewal fees

There are fees associated with the renewal process, which must be paid when the application is submitted. Fees can vary, so it is essential to check the up-to-date figures.

Important considerations

It is important that the investment that gave rise to the Golden Visa Portugal is maintained throughout the period of validity of the residence permit.

Can the family accompany the Golden Visa holder?

Yes, the family can accompany the Golden Visa Portugal holder through the family reunification process. The program allows holders to include eligible family members in their application, giving them the same rights of residence.

This means that family members can live, study and work in Portugal, benefiting from the same privileges as the investment holder. Eligible family members who can be included in the Golden Visa Portugal application are:

- Spouse or common-law partner;

- Underage children or dependents under the guardianship of the couple or one of the partners;

- Children under the age of 26 who are single and students at an educational institution;

- Parents of the Golden Visa Portugal holder(s) or of the spouse(s) or partner(s), over 66 years of age or over 55 years of age, provided they are proven dependents;

- Minor siblings, provided they are under the guardianship of the couple or one of the partners.

Family inclusion process

To include family members in the Golden Visa Portugal process, the holder of the investment must complete the following steps:

Submit documentation

Submit the necessary documentation for each family member, including valid passports, birth or marriage certificates to prove the family relationship and criminal record certificates.

Prove means of subsistence

Demonstrate financial capacity to support family members during their stay in Portugal.

Health insurance

Acquire health insurance valid in Portugal for all family members included in the application.

Pay the associated fees

AIMA processing fees apply to both the Golden Visa holder and each family member included in the application.

How does taxation work for the investor? What taxes will I have to pay as a Golden Visa Portugal holder?

Taxation for Golden Visa Portugal holders depends on several factors, including whether they are considered tax residents in the country and the nature of their investments. Below is an overview of the taxation applicable to Golden Visa investors:

Tax resident

Anyone who stays in the country for more than 183 days in a tax year or owns a dwelling on any day of the tax year that suggests an intention to maintain and occupy it as a habitual residence is considered a tax resident in Portugal. Tax residents are taxed on worldwide income.

Non-Habitual Resident (NHR): tax residents can benefit from the NHR tax regime, which offers favorable tax rates on income from certain categories, including employment income and some sources of foreign income, subject to certain conditions.

Personal income tax (IRS): the rate varies according to the progressive IRS table, and can be as high as 48%. However, under the NHR, some types of foreign income and certain income from Portuguese sources can be taxed at a flat rate of 20%.

Capital gains tax: gains on the sale of assets may be subject to taxation, especially real estate and shares.

Tax on dividends and interest: may be taxed at a rate of 28%, unless they qualify for exemption or differentiated treatment under the NHR regime.

Non-Tax Resident

If you stay in Portugal for less than 183 days, you will be considered a non-tax resident and taxed only on income generated in Portugal.

IRS on Portuguese source income: income generated in Portugal, such as rental income or capital gains from the sale of real estate located in Portugal, is taxed at a flat rate of 25% for non-residents.

Stamp Duty on property transfers: applicable to the purchase of real estate in Portugal, ranging from 0.8% to 6% of the asset or purchase value of the property.

IMI (Municipal Property Tax): this is an annual tax on property ownership in Portugal, the rate of which varies according to the municipality and the property’s asset value.

Important considerations

Here are two important considerations that apply to both tax and non-tax residents:

Double taxation agreements: Portugal has agreements with several countries to avoid double taxation, which can influence how foreign income is taxed.

Tax returns: it is crucial to comply with annual tax return obligations, regardless of whether you are a tax resident or a non-tax resident. Given the complexity of the Portuguese tax system and the frequent updates to tax legislation, it is recommended to consult with a tax specialist or tax lawyer to obtain personalized guidance and ensure tax compliance, as well as maximize the tax benefits available.

How is it possible to acquire Portuguese citizenship with a Golden Visa?

As you’ve already seen, acquiring Portuguese citizenship through the Golden Visa Portugal program is a viable option for investors and their families, after meeting certain requirements and deadlines established by Portuguese law.

So, here are the main steps and conditions for Golden Visa holders to apply for Portuguese citizenship:

Residence requirements

Legal residence

You must have been legally resident in Portugal for at least five years, which is facilitated by the Golden Visa program.

Minimum periods of stay

During the five years, Golden Visa holders must comply with the minimum stay requirements in Portugal, which are 7 days during the first year and 14 days in subsequent two-year periods.

After five years, Golden Visa Portugal holders can apply for Portuguese citizenship.

Advantages of the Golden Visa program

The Portuguese Golden Visa program offers a number of significant benefits and advantages for foreign investors and their families, making it one of the most popular and attractive investment residency programs in Europe. Let’s now recap some of the main benefits and advantages associated with the Portuguese Golden Visa.

Freedom to reside in Portugal

Golden Visa holders have the right to live in Portugal, enjoying a high standard of living, a mild climate and a rich culture and history.

Free movement within the Schengen Area

Allows Golden Visa holders and their families free movement within the Schengen Area, facilitating travel and business in Europe.

Quality education and healthcare

Access to Portugal’s high-quality education system and excellent health services, both public and private.

Security

Portugal is consistently ranked as one of the safest countries in the world, offering a peaceful environment for families and investors.

Favorable tax regime

Possibility of benefiting from the tax regime for Non-Habitual Residents (NHR), which offers reduced rates and tax exemptions on certain types of income for a period of up to ten years.

Exemption from double taxation

For holders who become tax residents, Portugal has double taxation exemption agreements with several countries, reducing the tax burden on international income.

Eligibility for citizenship

After five years of legal residence, Golden Visa holders can apply for Portuguese citizenship, offering the opportunity to become a citizen of the European Union with all the associated rights.

Inclusion of family members

The program allows direct family members to be included in the application, such as a spouse or partner, dependent children and dependent parents, extending the residency benefits to them.

Diversified investment options

Despite recent changes that exclude direct real estate investments in high-density metropolitan areas, the program still offers diverse investment options.

Stability and growth

Investing in Portugal through the Golden Visa offers the potential for long-term growth and appreciation in a stable real estate and economic market.

Quality of life

Portugal is known for its high quality of life, with excellent gastronomy, rich cultural heritage, beautiful landscapes and one of the highest rates of sunny days in Europe.

In short, the Golden Visa Portugal represents not just an investment opportunity, but a gateway to a better life, with security, stability and access to the benefits of the European Union.

Advice for Golden Visa Portugal

You’ve almost finished reading. As there has been a lot of information, you are surely thinking that you will need specialized professional support to carry out the entire process of your Golden Visa Portugal and, in fact, it is the best way to avoid mistakes and delays.

Hiring specialized advice for the Golden Visa Portugal process can be decisive for the success of the application, especially considering the complexity of the legal and bureaucratic requirements involved.

VIDA, as an investment fund that facilitates the entire Golden Visa process from start to finish, offers a perfect example of how advice can add significant value to investors.

Here are some reasons why hiring an advisor like VIDA can be extremely beneficial:

In-depth knowledge

VIDA has in-depth knowledge of the Golden Visa program, including the latest changes in legislation and eligibility criteria. This ensures that investors receive accurate and up-to-date guidance.

Simplified processes

The application process for Golden Visa Portugal can be complex and time-consuming. VIDA can simplify this process by guiding investors through each stage, from choosing the investment to submitting the application, reducing the bureaucratic burden.

Choosing the right investments

With the recent change in legislation that excludes the direct purchase of real estate as an investment option for the Golden Visa, VIDA can offer investment alternatives that qualify for the program and that align with each investor’s financial goals.

Family reunification support

VIDA can assist not only the main holder of the Golden Visa Portugal, but also offer support in the family reunification process, ensuring that all eligible family members can benefit from the program.

Preparation and submission of documentation

The fund ensures that all the necessary documentation is prepared correctly, translated and submitted in accordance with AIMA requirements, avoiding delays or rejections in the application.

Legal and tax advice

The company can also provide legal and tax advice, helping investors to understand the tax implications of their investments in Portugal and to take advantage of advantageous tax regimes, such as RNH (Non-Habitual Resident).

Access to a network of professionals

Through VIDA, investors have access to a network of trusted professionals, including lawyers, accountants and real estate consultants, facilitating a smooth and efficient investment experience.

Post-investment follow-up

In addition to facilitating the process of obtaining a Golden Visa Portugal, VIDA can offer post-investment support, helping with the renewal of the visa and the eventual application for Portuguese citizenship.

By choosing to work with an advisory firm like VIDA, investors can not only increase their chances of success in the Golden Visa program, but also maximize the potential of their investments in Portugal, benefiting from a simplified process and comprehensive support.